Intro

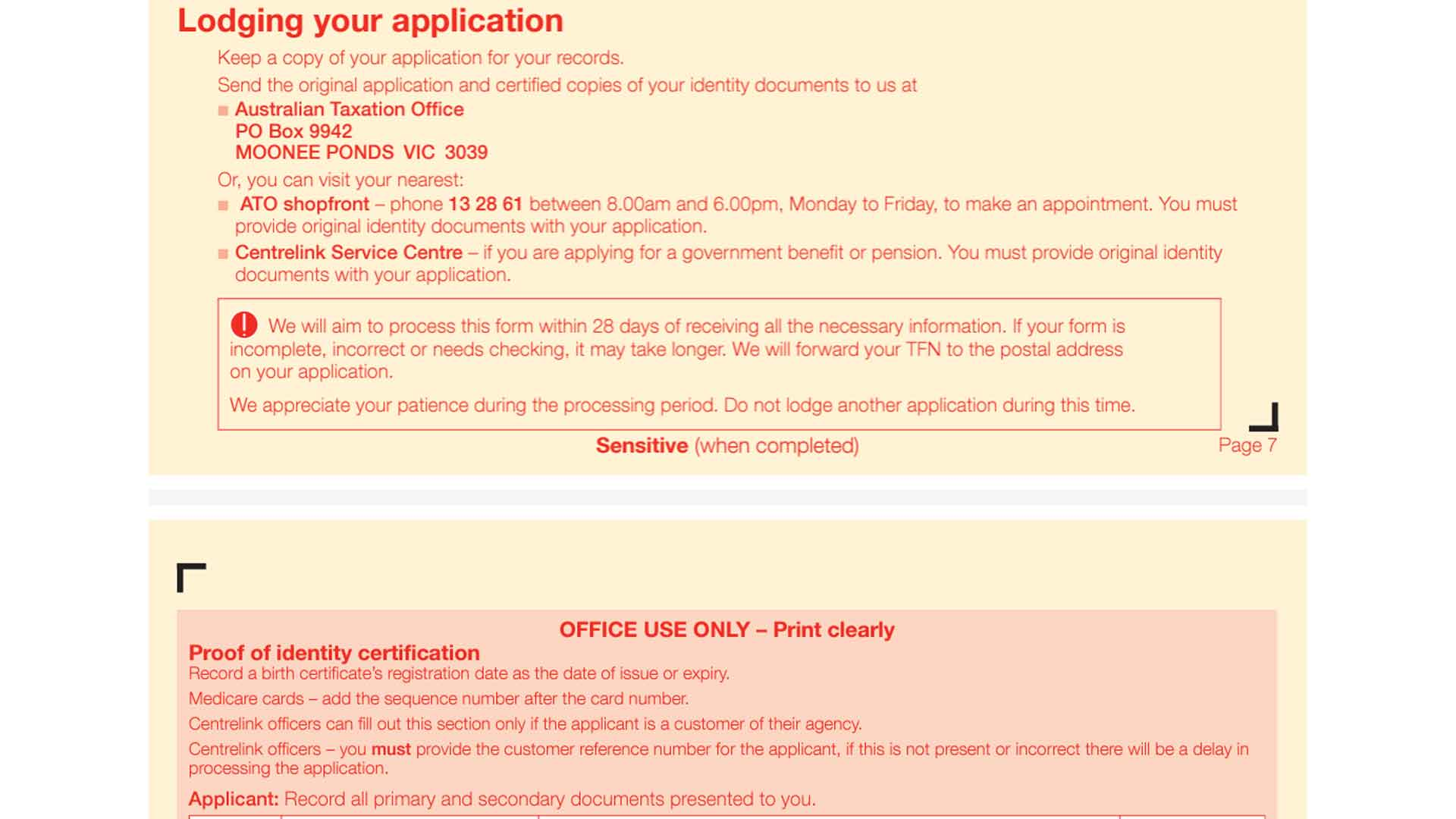

When you want to apply for TFN and fill tax file number application, it is vital to know the important details. Thus, you can apply for a tax file number in Australia correctly. The TFN application form is available online at www.ato.gov.au, and you can apply for TFN online within a few minutes. However, you will require a postal address in Australia and other things depending you are a foreigner or an Australian citizen. So, you can visit the website and start filling out the ATO TFN application. Once the tax file number application form is done and submitted, it will take up to 28 days. Therefore, we have prepared a step-by-step guide for you to easily ATO apply for TFN in Australia.

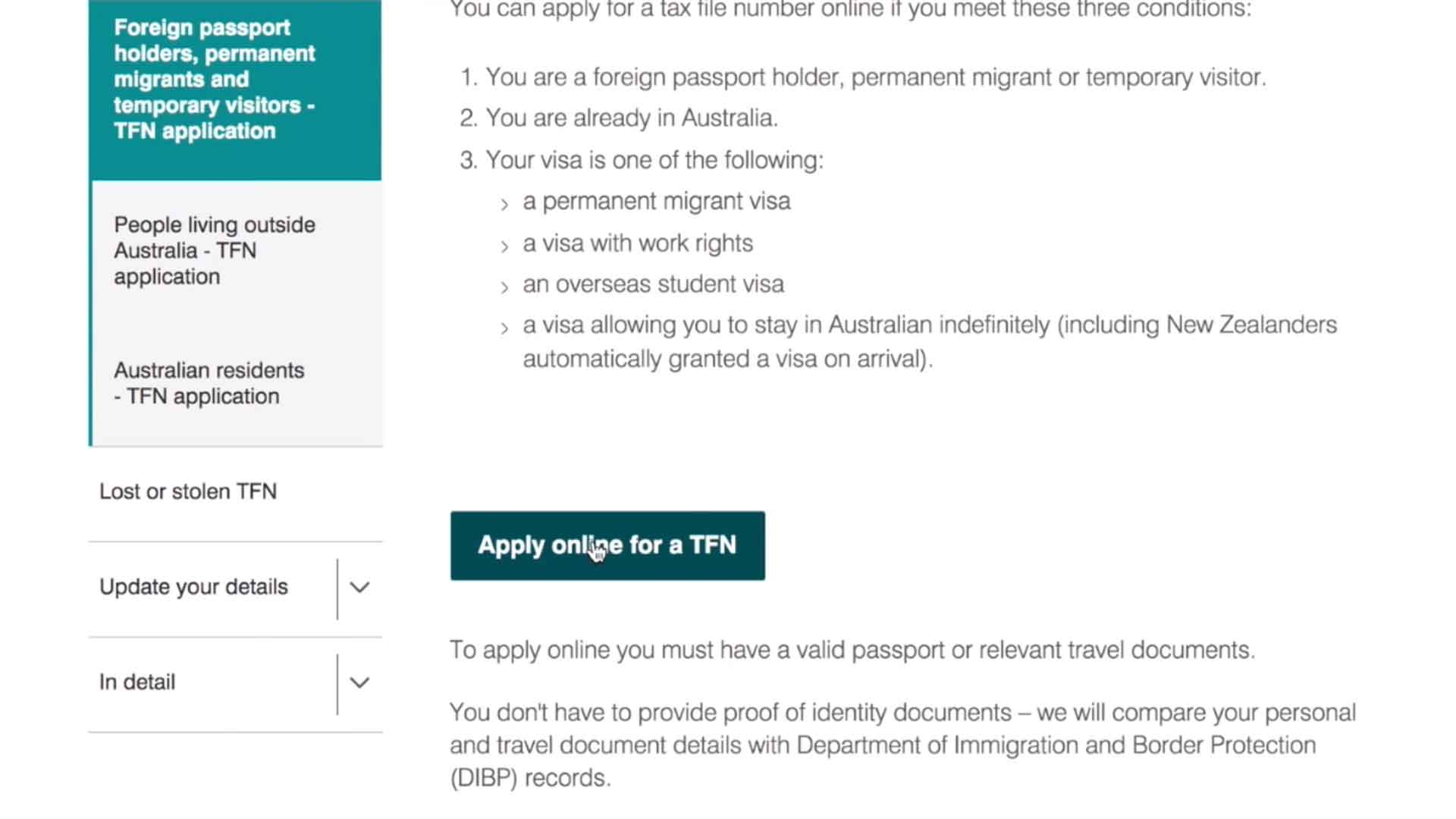

Who can apply for TFN online in Australia?

You can apply for a tax file number in Australia by submitting an ATO tax file number application on paper or online. There is an official government website where you can apply for TFN online and fill out

the ATO TFN application. You must pay taxes whether you are an Australian citizen or a foreigner working in Australia. Regardless of your residential status, you must fill out the TFN application form and apply for a tax file number. So, you will pay less in taxes. People who do not have TFN or do not ATO apply for TFN have to pay a larger percentage of taxes. Thus, you must get a tax file number as soon as possible.

How to apply for TFN in Australia?

You can visit the ATO office near your location or apply for a tax file number online. The official ATO website offers all types of scenarios to get a tax file number. These include citizens with Australian passports, people who do not have a passport, Australian residents, and foreign passport holders. Also, people living outside Australia, Norfolk Island residents, and Aboriginal and Torres Strait Islander people are included. Permanent Migrants and temporary visitors can also fill ATO TFN application. Hence, you can apply for TFN online. If you have a GovID and are 15 years or older, you can fill out the TFN

application form on paper or online.

What documents will you require to get a tax file number?

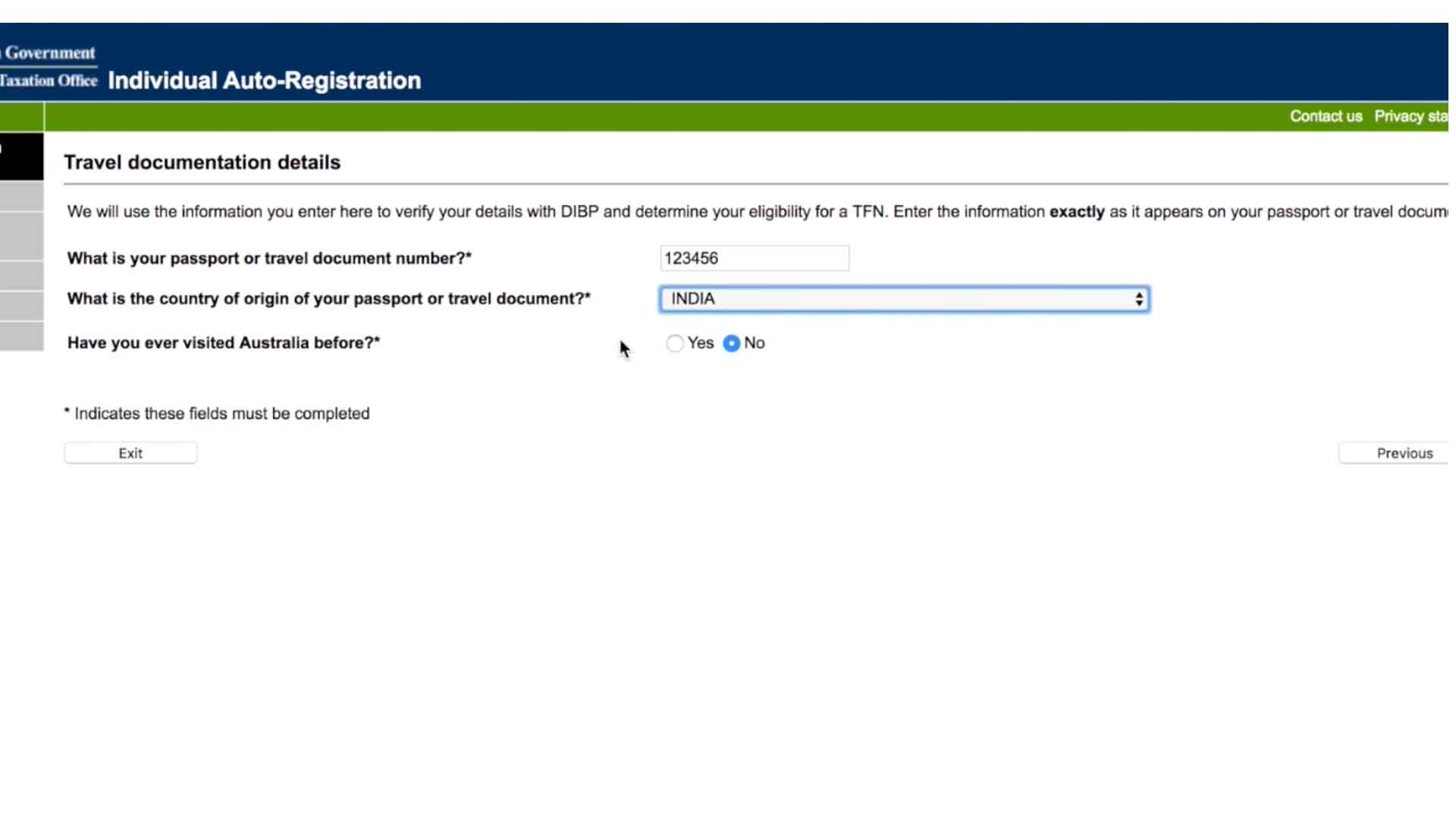

You can apply for TFN online or on paper to get a tax file number in Australia. But you need documents to prove your identity or business resident outside Australia. You will require copies of ID documents. Also, you require to present certified copies of ID documents. A Barrister, medical professional, Judge, Police Officer, Bank, or Building Society officer can be the certifier. Therefore, you can attach certified copies of documents to apply for TFN online in Australia. You can also get the ATO tax file number application form from the Australian post office, ATO shop, or by post.

Step-by-Step Guide for ATO Tax File Number Application

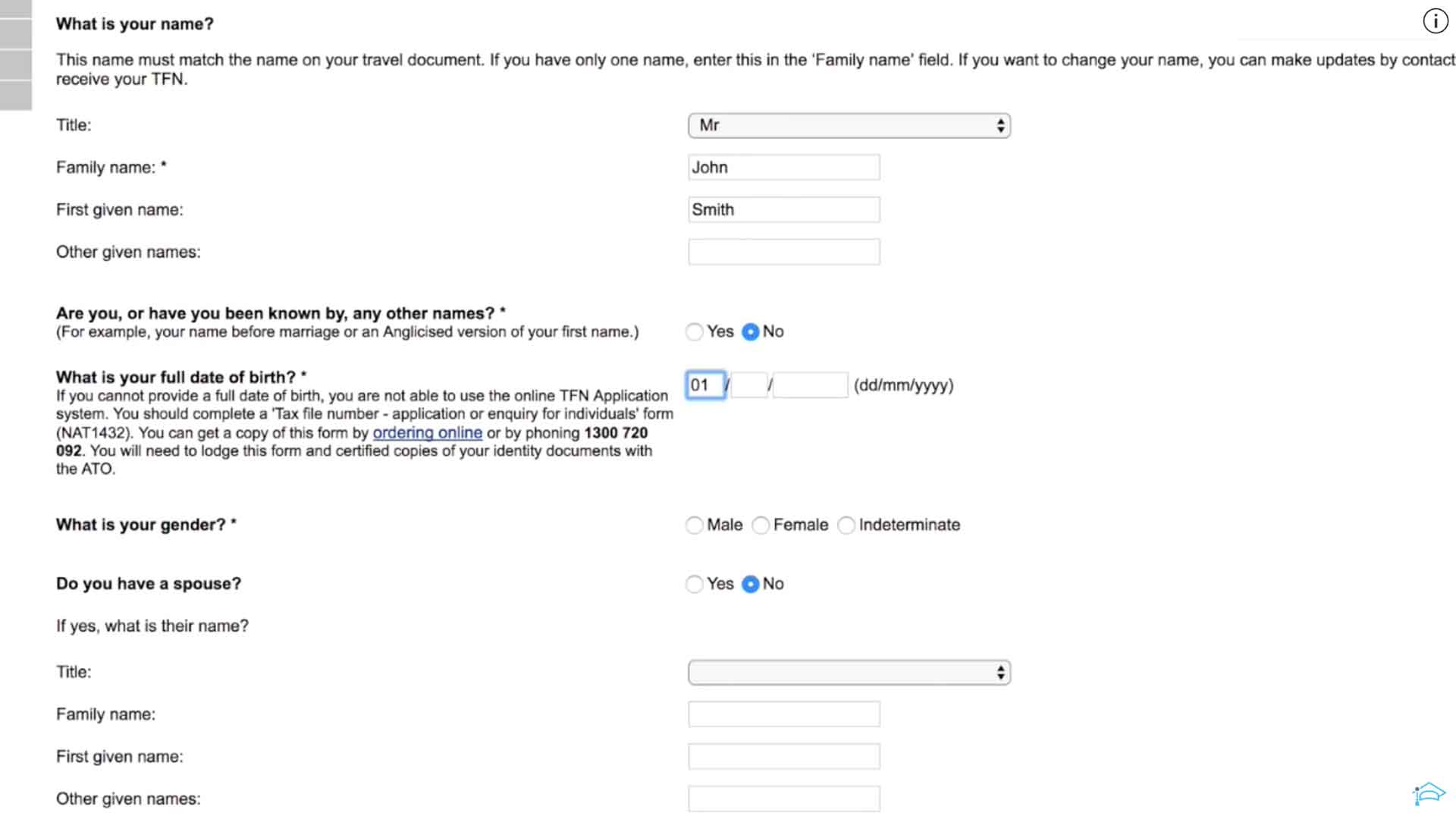

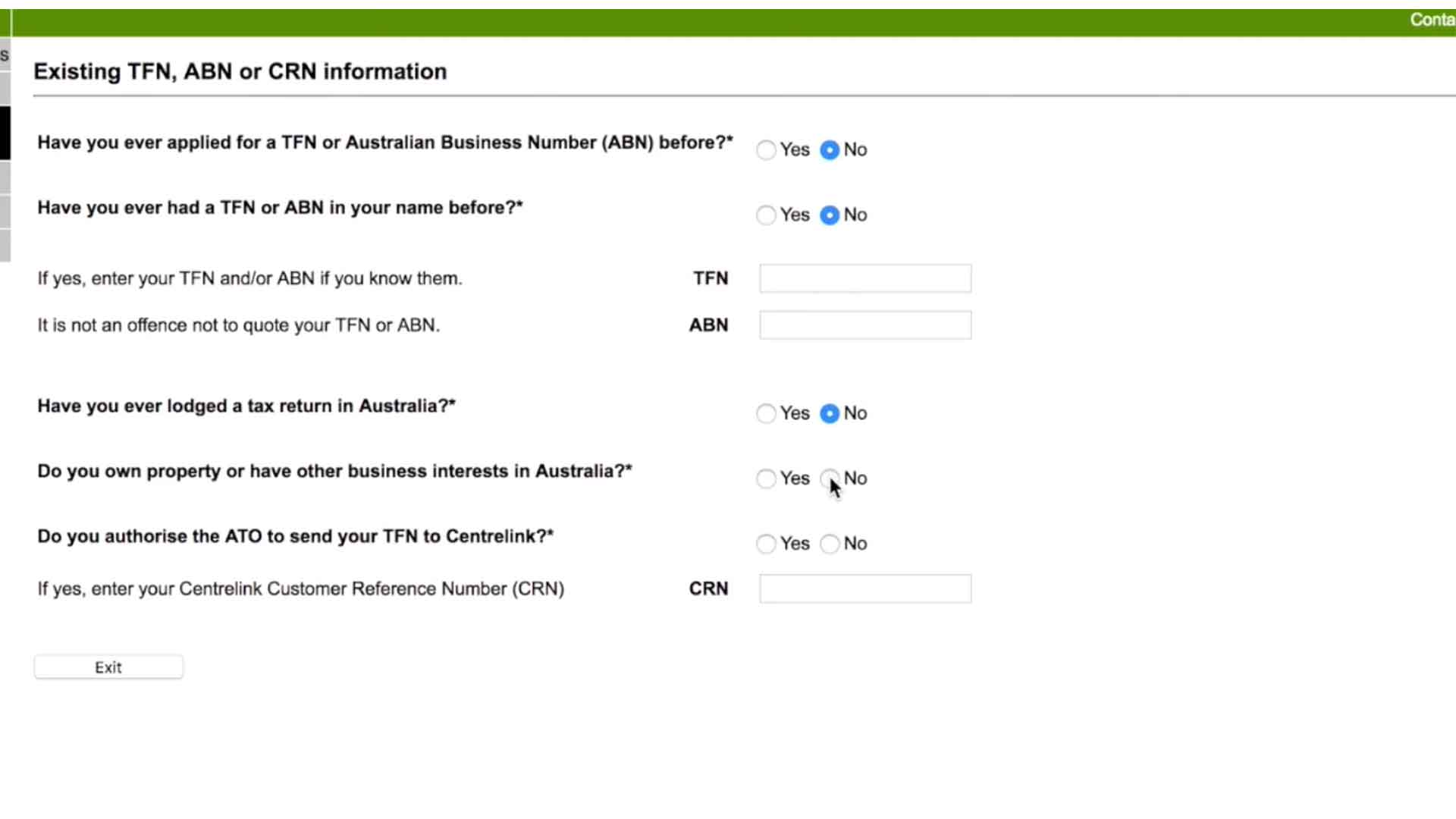

You also need to apply for a myGov account and link your TFN to reap the most benefits of tax refunds. It is a secure way to access all the available government services. You can visit the my.gov.au website for more info. We have a step-by-step guide for the ATO TFN application. So you can fill out the TFN application form. It only takes 10 minutes to apply for TFN online. Visit www.ato.gov.au and select the individual, business, or other criteria that match your situation. Thus, you can fill out the ATO tax file number application. You will need your certified identity documents.

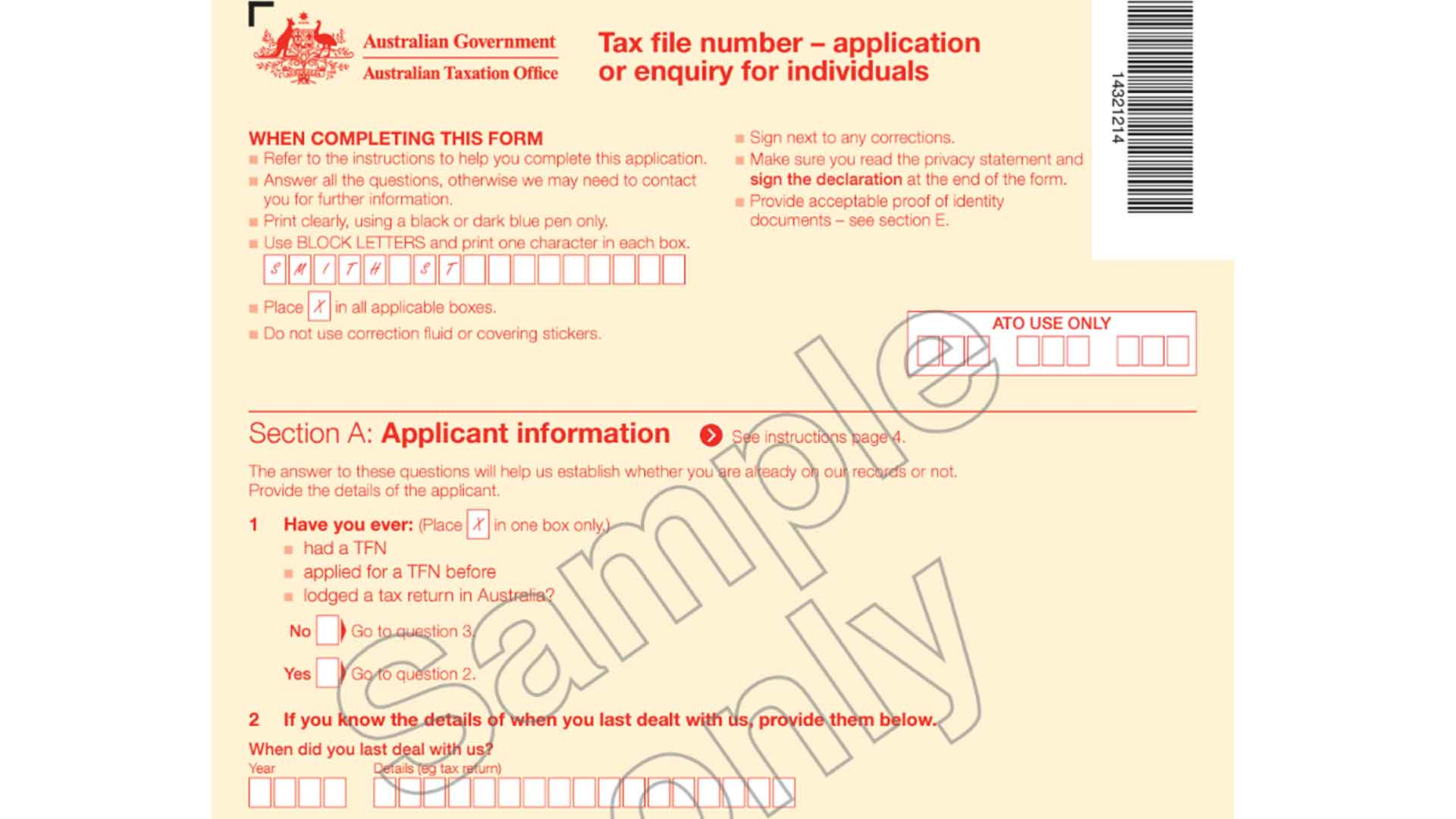

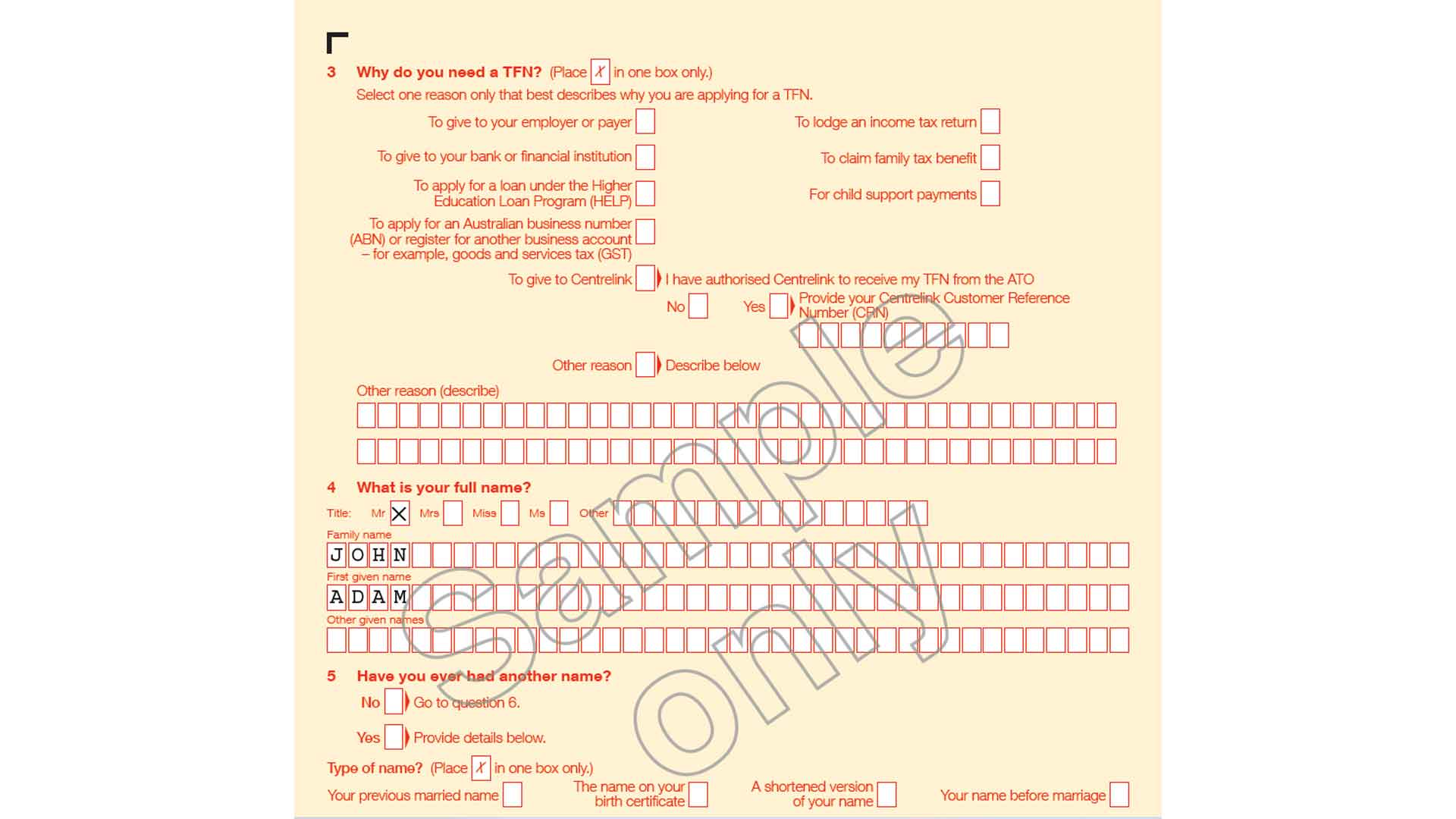

Section A of TFN Application Form (Paper form)

It is the first section of a tax file number application form. If you have applied for ATO TFN application before, you have to fill in your family name. And postal address and answer a few questions. On the top of the form, there are instructions provided for how to fill out the ATO TFN application form. Read these carefully. For example, it says to fill out the TFN application form using Block Letters in each box. Place an “X” inside the box where instructed. However, you can skip question no.3 as instructed by answering question no.1. There you can fill in your details and spouse details, etc.

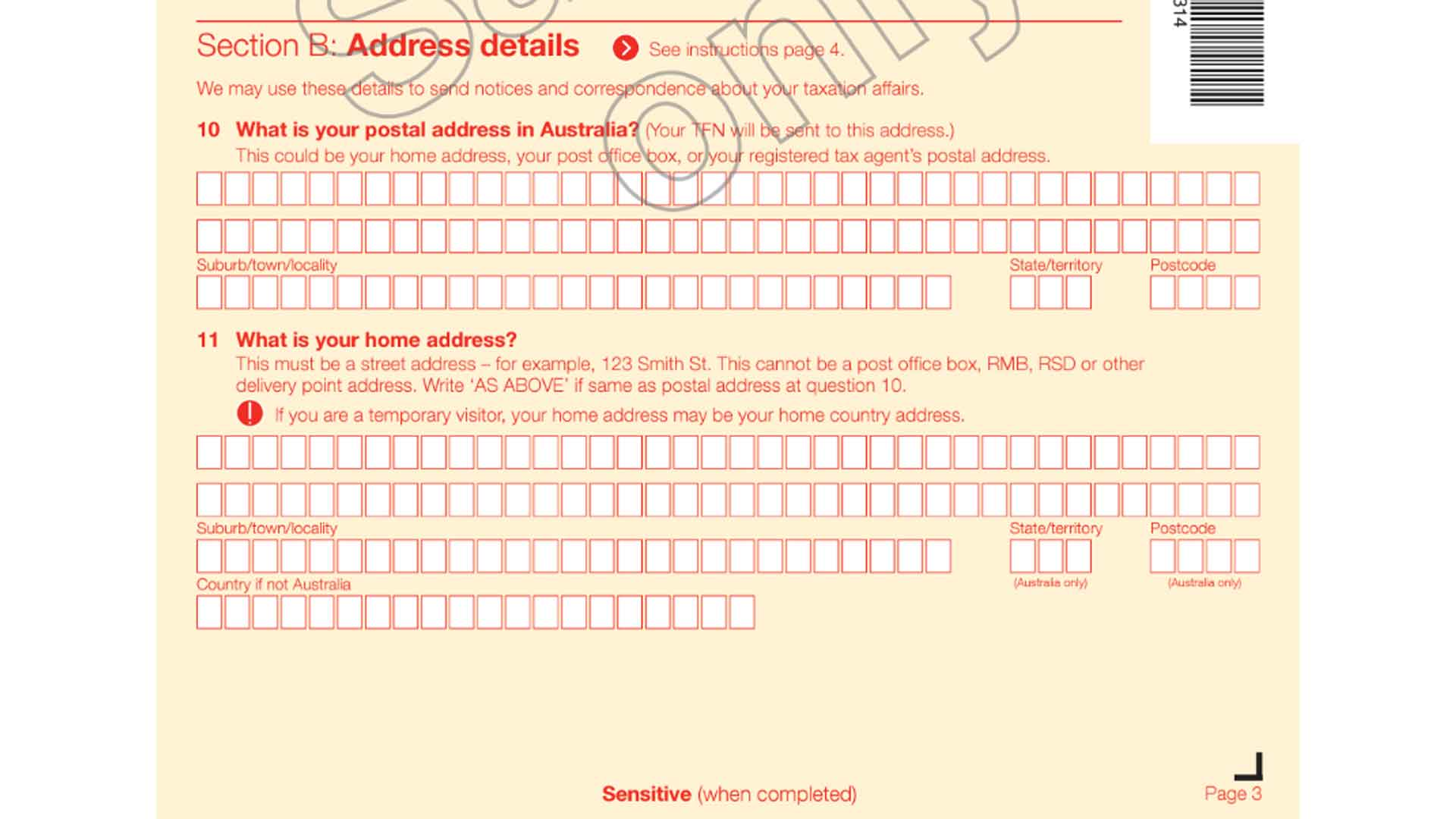

Section B

Here, you have to fill in your residential address.

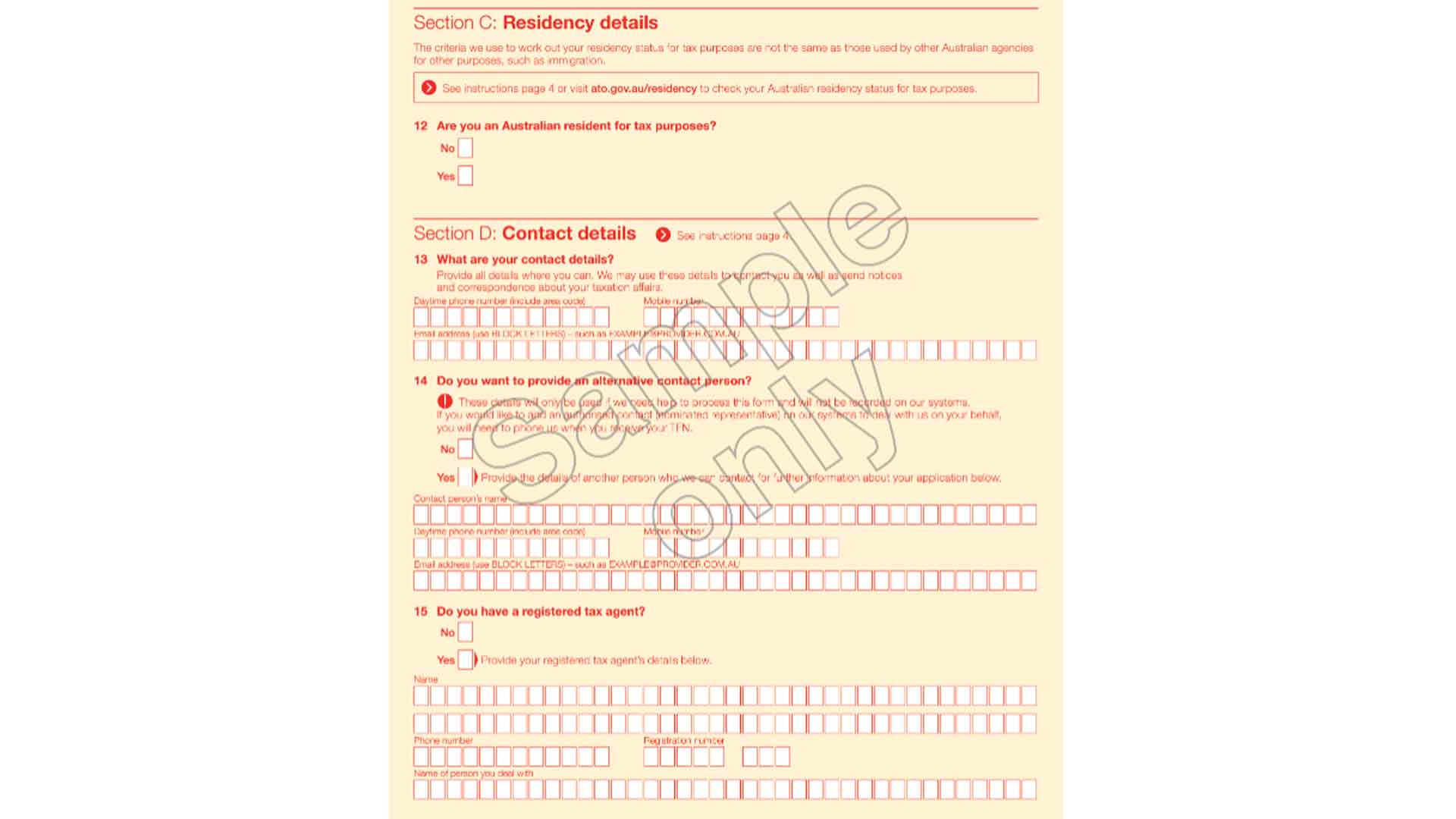

Sections C and D

You have to fill in Section C of the TFN application form for residency details. Section D is for asking for contact details and document information. So you can answer the questions.

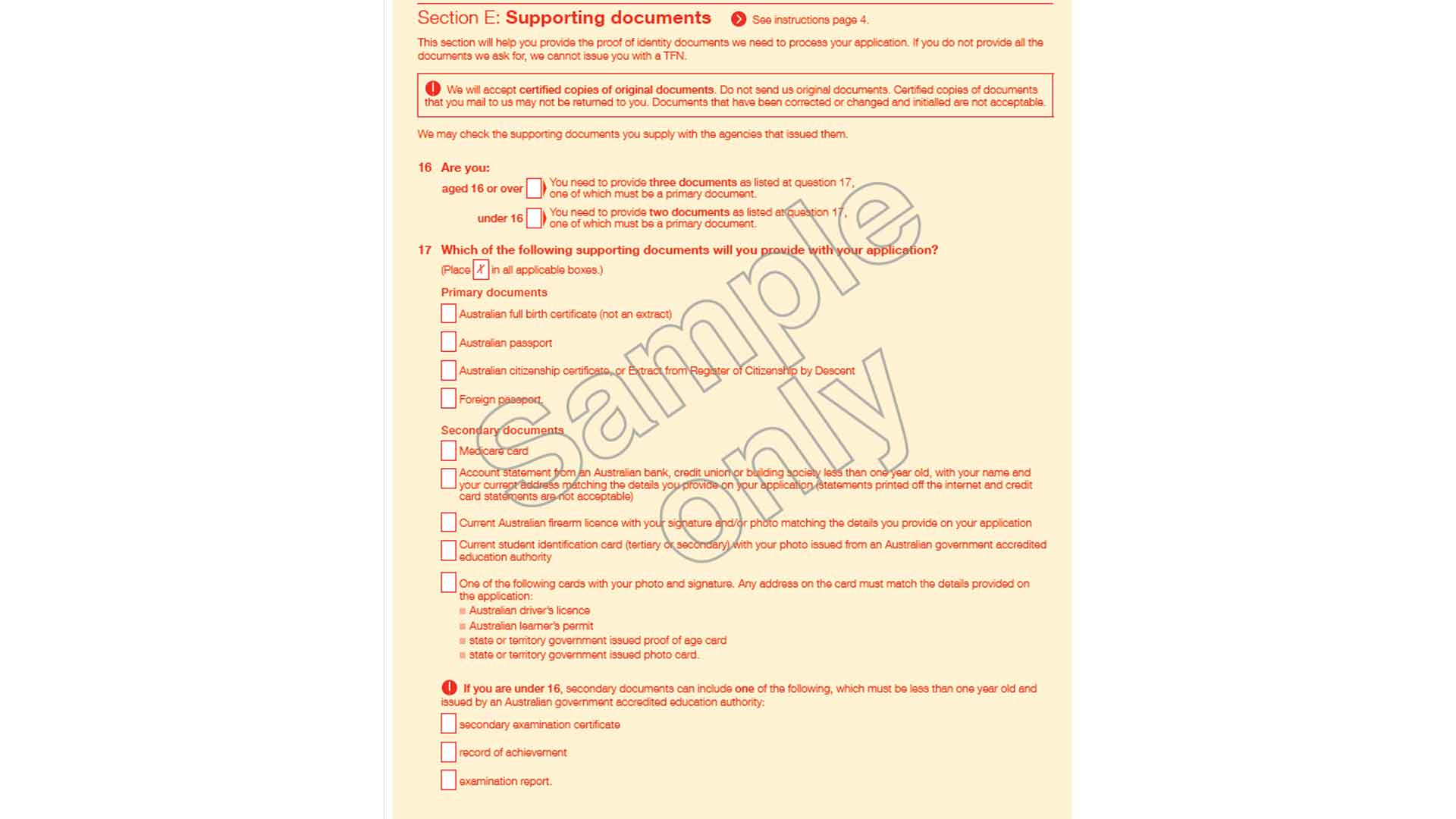

Section E

Section E is for the supporting documents to prove your identity. It is an important part of an ATO tax file number application form.

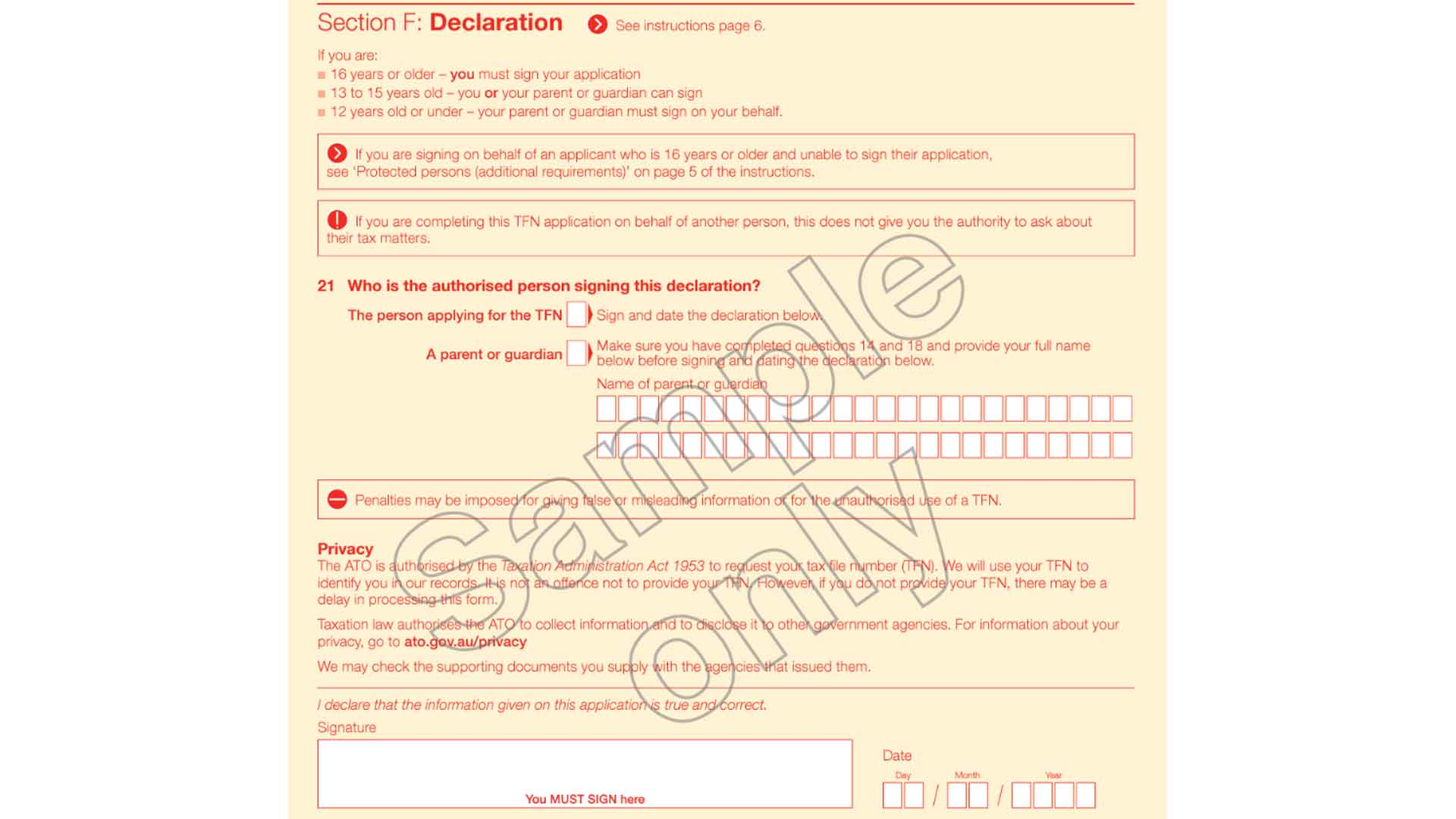

Section F

This section of the TFN application form is for declaration.

After filling out all the details, you can keep a copy with yourself and lodge the original form to the provided addresses in the form with the certified ID documents.

You can use the paper TFN application form or apply for TFN online. You only require a single TFN number to claim tax benefits in Australia. When you apply online for the ATO tax file number application, provide the correct details and attach the certified ID documents. Also, provide the correct contact details and postal address to get a tax file number. The process may take up to 28 days online.